Export Tuna of Vietnam: Strategic Growth Opportunities for Global Importers in 2025

In 2025, export tuna of Vietnam is showing strong signs of recovery and strategic repositioning in the global seafood market. According to the latest data from VASEP, May brought notable shifts in key markets due to evolving U.S. trade policies and instability in the Middle East. For importers worldwide, understanding these changes is essential to making informed sourcing decisions.

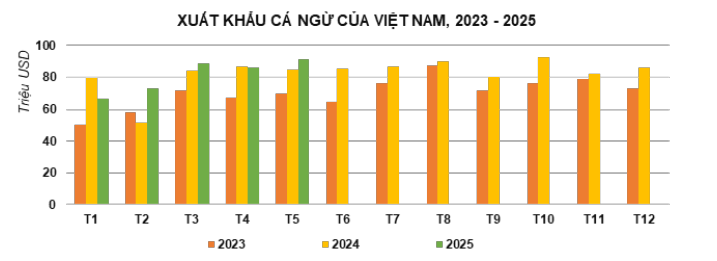

Quick view

1. U.S. Market Leads the Surge in Demand

The United States continues to be the leading destination for export tuna of Vietnam. In the first five months of 2025, the U.S. accounted for 41% of Vietnam’s total tuna export volume. After facing slower growth in April due to the imposition of temporary countervailing duties, Vietnamese exporters swiftly adapted. In May alone, exports to the U.S. rose sharply by 37%.

This acceleration reflects proactive shipment strategies ahead of the July 9 deadline when the 90-day temporary tariff period ends. Forecasts suggest exports to the U.S. could climb to 46% by mid-July, making it a priority market for Vietnamese tuna suppliers.

2. EU and Middle East: Mixed Signals for Importers

While the U.S. shows robust recovery, the European Union tells a more cautious story. Tuna exports to the EU fell by 11% in May 2025. Although markets like the Netherlands and Italy maintained moderate growth (11% and 15%, respectively), Germany experienced a sharper decline.

Meanwhile, political unrest in the Middle East is affecting demand. Exports to Israel dropped 42% year-on-year. Saudi Arabia and the UAE also recorded steep declines, down 89% and 52%, respectively. These challenges highlight the importance of flexible sourcing strategies for buyers in these regions.

3. CPTPP Markets Offer Bright Prospects

One of the most promising developments is the resurgence in CPTPP member countries. In May 2025, export tuna of Vietnam to this bloc increased by 25%. Japan and Canada, in particular, demonstrated strong import demand. These countries are key partners under the CPTPP agreement, offering reduced tariffs and streamlined customs procedures, which make them attractive for long-term export growth.

4. Market Diversification: A Lesson in Risk Management

The current export landscape underscores the value of market diversification. Vietnamese tuna exporters are expanding into new regions while reinforcing trade relations with reliable markets. For international buyers, especially B2B seafood importers, this means more consistent supply and competitive pricing.

Export tuna of Vietnam is not only resilient but also adaptable. With improved traceability, compliance with international standards, and high processing capabilities, Vietnam remains a trusted partner for importers seeking quality, sustainability, and supply stability.

5. Why Importers Should Watch the Export Tuna of Vietnam in 2025

The message is clear: 2025 is a turning point for Vietnam’s tuna industry. From favorable trade agreements like CPTPP to strategic maneuvering in key markets, the export tuna of Vietnam is poised for sustainable growth.

For seafood distributors, wholesalers, and foodservice chains, this is the ideal time to explore partnerships with Vietnamese suppliers. Stay ahead of the competition by securing your sourcing strategy in one of the most dynamic seafood export sectors today.

—————————————————————————————————————-

For advice and support, please contact Mekong Seafood Connection via the information below:

Mr. Hoang Duy – Commercial Director

Mobile/WhatsApp/Wechat: +84 903 872 469

Email: hoang@mekseaconnection.com

Anna Tran (Meksea Team)

Reference VASEP

If you found this topic interesting, please click the Like button below so we may continue to expand this topic. Leave a comment with your thoughts for the author team to discuss.